From Ground Truth to Blockchain Proof

Our verification stack integrates community plots, satellite analytics and immutable on-chain timestamps — producing registry-ready, auditable carbon credits.

Capture

Field plots, soil cores, IoT sensors and high-resolution satellite imagery (Sentinel / Planet).

Verify

AI anomaly detection + human QA — precision testing on held-out datasets with conservative thresholds to minimise over-crediting.

Record

Hashing of MRV snapshots to blockchain (audit trail) and submission-ready packages for registries (Verra / Plan Vivo).

Data Sources

- Sentinel-2 / Landsat

- PlanetScope (where available)

- Field plots & soil cores

- Community dMRV reports

Market Opportunity

The voluntary carbon market reached approximately US$2.3B in 2024. Demand continues to rise as corporates accelerate net-zero commitments.

Key Benchmarks

Projection (Illustrative)

Example revenue projection for a 1,000 ha portfolio using conservative crediting assumptions. (See investor annex for model.)

De-risking for Corporate Buyers

We combine technology and financial instruments to minimise buyer risk and simplify procurement for corporate ESG teams.

Risk & Coverage

How it helps corporates

- Faster procurement cycles

- Audit-ready reporting exports

- Reduced reputational risk through transparent proofs

Meet ESG Goals — Without the Sweat

Automated export templates for GRI, SASB/ISSB, TCFD and CSRD make corporate disclosures tidy and auditable.

One-click Exports

CSV / JSON / PDF exports aligned to framework line-items for easy integration with sustainability reporting tools.

Audit-ready Data

Every exported metric is traceable back to a hashed MRV snapshot for audit and regulator review.

Standards & Frameworks

Aligned with recognised global standards for carbon accounting, disclosure and data security.

ISO 14064

GHG accounting and verification standards for organisations and projects.

GHG Protocol

Corporate and project GHG accounting framework (Scopes 1–3).

Verra (VCS)

Verified Carbon Standard and global registry alignment.

Gold Standard

High-integrity carbon credits aligned to UN SDGs.

IFRS S2

Climate-related disclosures for investor-grade reporting.

EU CSRD

European corporate sustainability reporting directive compliance.

SOC 2 Type II

Operational security and controls for SaaS platforms.

ISO 27001

Information security management standard.

Full alignment with ISO 14064, GHG Protocol, and enterprise security standards.

Logos and trademarks are the property of their respective owners and are used here for informational reference only.

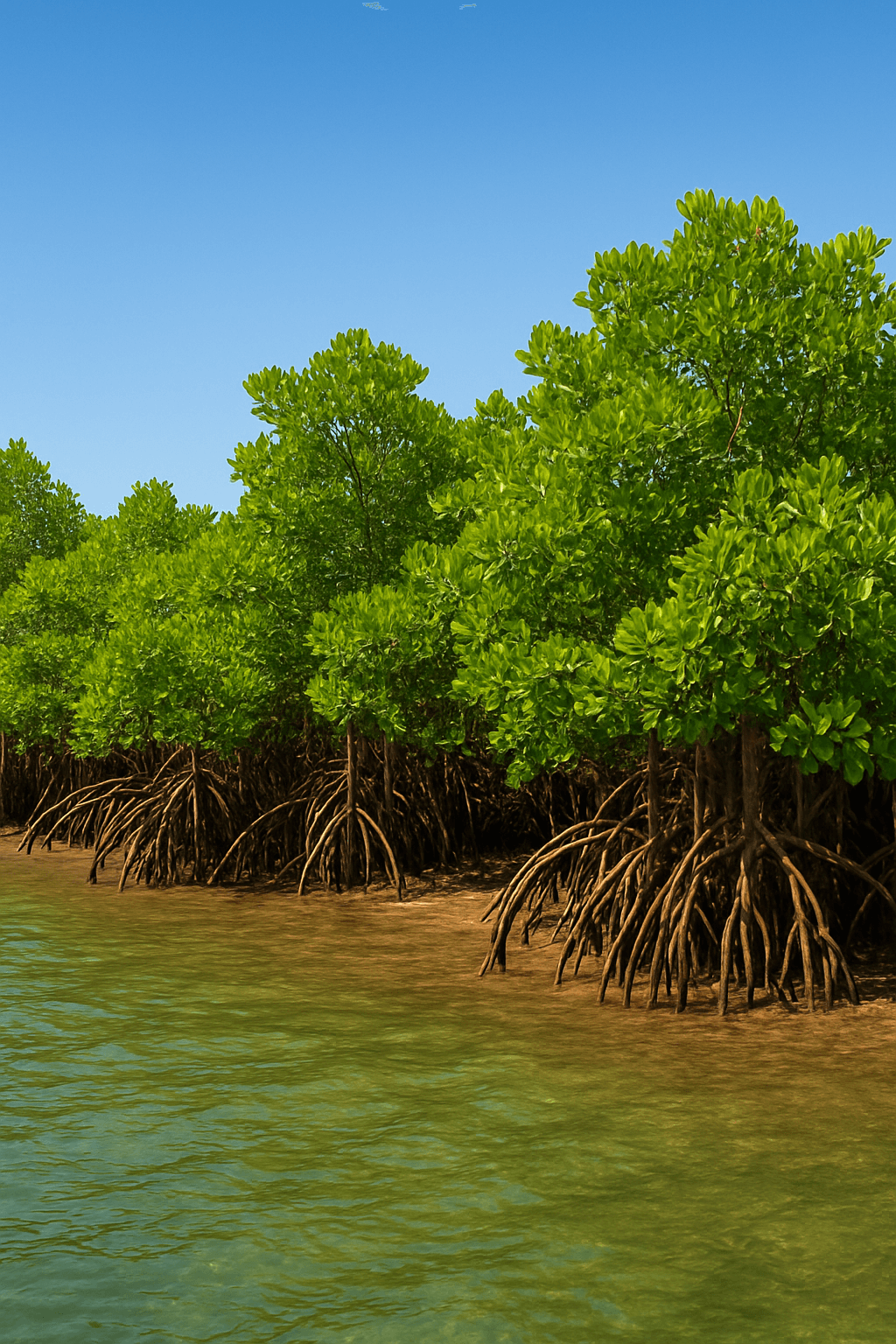

Featured Project — Mikoko Pamoja (Gazi Bay, Kenya)

All figures are referenced from Plan Vivo, peer-reviewed studies and public reports.View Plan Vivo entry

Platform Benchmarks

Verification Time

Anomaly Detection

Data Sources

Market Price Band

* All Platform Benchmarks shown are estimates based on pilot data and market analysis.

Frequently Asked Questions

Get answers to common questions about carbon credits, blue carbon projects, dMRV technology, and the Karbon Assure platform.

What is Karbon Assure?

Karbon Assure is an automated dMRV (digital Measurement, Reporting, and Verification) platform that enables accelerated verification of carbon projects using automated MRV, blockchain transparency and insurance-backed credit buffers.

How does carbon credit verification work?

Our platform uses automated dMRV processes, AI-driven validation, and blockchain audit trails to verify carbon credits. We integrate satellite imagery, IoT sensors, and field data to produce registry-ready, auditable carbon credits.

What types of carbon projects does Karbon Assure support?

We specialize in blue carbon and mangrove restoration projects, supporting community-led initiatives that deliver verified carbon credits. Our platform is designed for scalable carbon portfolios.

How long does verification take?

Our automated verification process takes less than 48 hours, compared to industry standards of 60-120 days. This accelerated timeline is achieved through automated pre-checks and AI-driven validation.

What is blue carbon?

Blue carbon refers to carbon captured and stored in coastal ecosystems such as mangroves, seagrass meadows, and salt marshes. These habitats absorb CO₂ at up to four times the rate of terrestrial forests.

How do verified credits support ESG frameworks?

Each credit's metadata is mapped to GRI, TCFD, CSRD, and IFRS S2 disclosure categories for seamless integration into corporate sustainability reports.

Partner with the Future of Carbon Verification

Join our pilot program to shape standards of trust for blue carbon and high-quality nature-based solutions.